After decades of squirreling abroad money in tax-advantaged retirement accounts, investors entering their 70s accept to cast the script. Starting at age 72, Uncle Sam requires taxpayers to draw bottomward their retirement anniversary accumulation through anniversary appropriate minimum distributions. Not alone do you charge to anniversary how abundant charge be aloof anniversary year, you charge pay the tax on the distributions.

There’s no time like the present to get up to acceleration on the RMD rules. Once you apperceive the basal rules, you can use acute strategies to abbreviate taxable distributions and accomplish the best of the money that you charge withdraw.

Here are 12 things you should accede regarding required minimum withdrawals.

The SECURE Act afflicted back you charge alpha demography RMDs. Beneath the 2019 legislation, if you angry 70 ½ in 2019, again you should accept taken your aboriginal RMD by April 1, 2020. If you angry 70 ½ in 2020 or later, you should booty your aboriginal RMD by April 1 of the year afterwards you about-face 72. All consecutive ones charge be taken by December 31 of anniversary year.

This about applies to the aboriginal buyer of a acceptable IRA, SIMPLE IRA, SEP IRA or a retirement plan, such as a 401(k) or 403(b). Roth IRAs do not accept RMDs.

The RMD is burdened as accustomed income, with a top tax bulk of 37% for 2021 and 2022.

An anniversary buyer who delays the aboriginal RMD will accept to booty two distributions in one year. For instance, a aborigine who turns 72 in March 2021 has until April 1, 2022, to booty his aboriginal RMD. But he’ll accept to booty his additional RMD by December 31, 2022.

Taking two RMDs in one year can accept important tax implications. This could advance you into a college tax bracket, acceptation a above allocation of your Social Security assets could be accountable to taxes, or you could additionally end up advantageous added for Medicare Allotment B or Allotment D.

To actuate the best time to booty your aboriginal RMD, analyze your tax bills beneath two scenarios: demography the aboriginal RMD in the year you hit 72, and dabbling until the afterward year and acceleration up RMDs.

To anniversary your RMD, bisect your anniversary anniversary antithesis from the antecedent year by the IRS life-expectancy agency based on your altogether in the accepted year.

If you own assorted IRAs, you charge to anniversary the RMD for anniversary account, but you can booty the absolute RMD from aloof one IRA or any aggregate of IRAs. For instance, if you accept an IRA that’s abate than your absolute RMD, you can abandoned out the baby IRA and booty the butt of the RMD from a above IRA.

A retiree who owns 401(k)s at age 72 is accountable to RMDs on those accounts, too. But clashing IRAs, if you own assorted 401(k)s, you charge anniversary and booty anniversary 401(k)’s RMD separately.

You can booty your anniversary RMD in a agglomeration sum or piecemeal, conceivably in annual or annual payments. Dabbling the RMD until year-end, however, gives your money added time to abound tax-deferred. Either way, be abiding to abjure the absolute bulk by the deadline.

What happens if you absence the deadline? You could get hit with one of Uncle Sam’s harshest penalties—50% of the shortfall. If you were declared to booty out $15,000 but alone took $11,000, for example, you’d owe a $2,000 amends additional assets tax on the shortfall.

But this harshest of penalties may be forgiven—if you ask for relief—and the IRS is accepted to be almost allowing in these situations. You can appeal abatement by filing Form 5329, with a letter of annual including the activity you took to fix the mistake.

One way to abstain forgetting: Ask your IRA babysitter to automatically abjure RMDs.

There are a cardinal of instances area you can abate RMDs—or abstain them altogether. If you are still alive above age 72 and don’t own 5% or added of the company, you can abstain demography RMDs from your accepted employer’s 401(k) until you retire.

However, you would still charge to booty RMDs from old 401(k)s you own. But there is a workaround for that. If your accepted employer’s 401(k) allows for money to be formed into the plan, you could do that. Doing that agency you won’t charge to booty an RMD from a 401(k) until you absolutely retire. (You would still charge to booty RMDs from any acceptable IRAs.)

For those who own Roth 401(k)s, there’s a breeze RMD solution: Cycle the money into a Roth IRA, which has no RMDs for the aboriginal owner. Assuming you are 59½ or earlier and accept endemic at atomic one Roth IRA for at atomic bristles years, the money formed to the Roth IRA can be broke tax-free.

Another band-aid to abstain RMDs would be to catechumen acceptable IRA money to a Roth IRA. You will owe tax on the about-face at your accustomed assets tax rate. But blurred your acceptable IRA antithesis reduces its approaching RMDs, and the money in the Roth IRA can break put as continued as you like.

Converting IRA money to a Roth is a abundant action to alpha early, but you can do conversions alike afterwards you about-face 72, admitting you charge booty your RMD first. Again you can catechumen all or allotment of the absolute antithesis to a Roth IRA. You can bland out the about-face tax bill by converting abate amounts over a cardinal of years.

This can advice you anticipate advantageous added in taxes in the future. For instance, while acceptable IRA distributions abacus back artful taxation of Social Security allowances and Medicare exceptional surcharges for advantageous taxpayers, Roth IRA distributions do not. And if you charge added assets unexpectedly, borer your Roth won’t access your taxable income.

A able constancy accomplishment contract, or QLAC, is an advantage to lower RMDs and adjourn the accompanying taxes. You can carve out up to $130,000 or 25% of your retirement anniversary balance, whichever is less, and advance that money in this appropriate blazon of deferred assets annuity. Compared with an absolute annuity, a QLAC requires a abate upfront advance for above payouts that alpha years later. The money invested in the QLAC is no best included in the IRA antithesis and is not accountable to RMDs. Payments from the QLAC will be taxable, but because it is constancy insurance, those payments won’t bang in until about age 85.

Another carve-out action applies to 401(k)s. If your 401(k) holds aggregation stock, you could booty advantage of a tax-saving befalling accepted as net abeyant appreciation. You cycle all the money out of the 401(k) to a acceptable IRA, but move the employer banal to a taxable account. You will anon pay accustomed assets tax on the bulk base of the employer stock. You will additionally still accept RMDs from the acceptable IRA, but they will be lower back you removed the aggregation banal from the mix. And any accumulation from affairs the shares in the taxable anniversary now qualifies for lower abiding capital-gains tax rates.

In the alpha of this story, we gave you the accepted RMD abacus that best aboriginal owners will use—but aboriginal owners with adolescent spouses can trim their RMDs. If you are affiliated to addition who is added than 10 years younger, bisect your anniversary anniversary antithesis by the IRS life-expectancy agency at the circle of your age and your spouse’s age in Table II of IRS Publication 590-B.

If you can’t abate your RMD, you may be able to abate the tax bill on the RMD—that is, if you accept fabricated and kept annal of nondeductible contributions to your acceptable IRA. In that case, a allocation of the RMD can be advised as advancing from those nondeductible contributions—and will accordingly be tax-free.

Figure the arrangement of your nondeductible contributions to your absolute IRA balance. For example, if your IRA holds $200,000 with $20,000 of nondeductible contributions, 10% of a administration from the IRA will be tax-free. Anniversary time you booty a distribution, you’ll charge to recalculate the tax-free allocation until all the nondeductible contributions accept been accounted for.

If you can’t abate or abstain your RMD, attending for means to accomplish the best of that appropriate distribution. You can body the RMD into your banknote breeze as an assets source. But if your costs are covered with added sources, such as Social Security allowances and alimony payouts, put those distributions to assignment for you.

While you can’t reinvest the RMD in a tax-advantaged retirement account, you can backing it in a drop anniversary or reinvest it in a taxable allowance account. If your aqueous banknote beanbag is sufficient, accede tax-efficient advance options, such as borough bonds. Index funds don’t bandy off a lot of basic assets and can advice accumulate your approaching tax bills in check.

Remember that the RMD doesn’t accept to be in cash. You can ask your IRA babysitter to alteration shares to a taxable allowance account. So you could move $10,000 annual of shares over to a allowance anniversary to amuse a $10,000 RMD. Be abiding the bulk of the shares on the date of the alteration covers the RMD amount. The date of alteration bulk serves as the shares’ bulk base in the taxable account.

The in-kind alteration action is decidedly advantageous back the bazaar is down. You abstain locking in a accident on an advance that may be adversity a acting bulk decline. But the action is additionally advantageous back the bazaar is in absolute area if you feel the advance will abide to abound in bulk in the future, or if it’s an advance that you aloof can’t buck to sell. In any case, if the advance avalanche in bulk while in the taxable account, you could autumn a tax loss.

If you are accurately inclined, accede a able accommodating distribution, or QCD. This move allows IRA owners age 70½ or earlier to alteration up to $100,000 anon to alms anniversary year. The QCD can abacus as some or all of the owner’s RMD, and the QCD bulk won’t appearance up in adapted gross income.

The QCD is a decidedly acute move for those who booty the accepted answer and would absence out on autograph off accommodating contributions. But alike itemizers can account from a QCD. Lower adapted gross assets makes it easier to booty advantage of assertive deductions, such as the write-off for medical costs that beat 7.5% of AGI in 2020. Because the QCD’s taxable bulk is zero, the move can advice any aborigine abate tax on Social Security or surcharges on Medicare premiums.

Say your RMD is $20,000. You could alteration the accomplished $20,000 to alms and amuse your RMD while abacus $0 to your AGI. Or you could do a nontaxable QCD of $15,000 and again booty a taxable $5,000 administration to amuse the RMD.

The aboriginal dollars out of an IRA are advised to be the RMD until that bulk is met. If you appetite to do a QCD of $10,000 that will abacus against a $20,000 RMD, be abiding to accomplish the QCD move afore demography the abounding RMD out.

Of course, you can do QCDs in balance of your RMD up to that $100,000 absolute per year.

You can additionally use your RMD to abridge tax payments. With the “RMD solution,” you can ask your IRA babysitter to abstain abundant money from your RMD to pay your absolute tax bill on all your assets sources for the year. That saves you the altercation of authoritative annual estimated tax payments and can advice you abstain underpayment penalties.

Because denial is advised to be analogously paid throughout the year, this action works alike if you delay to booty your RMD in December. By cat-and-mouse until afterwards in the year to booty the RMD, you’ll accept a bigger appraisal of your absolute tax bill and can fine-tune how abundant to abstain to awning that bill.

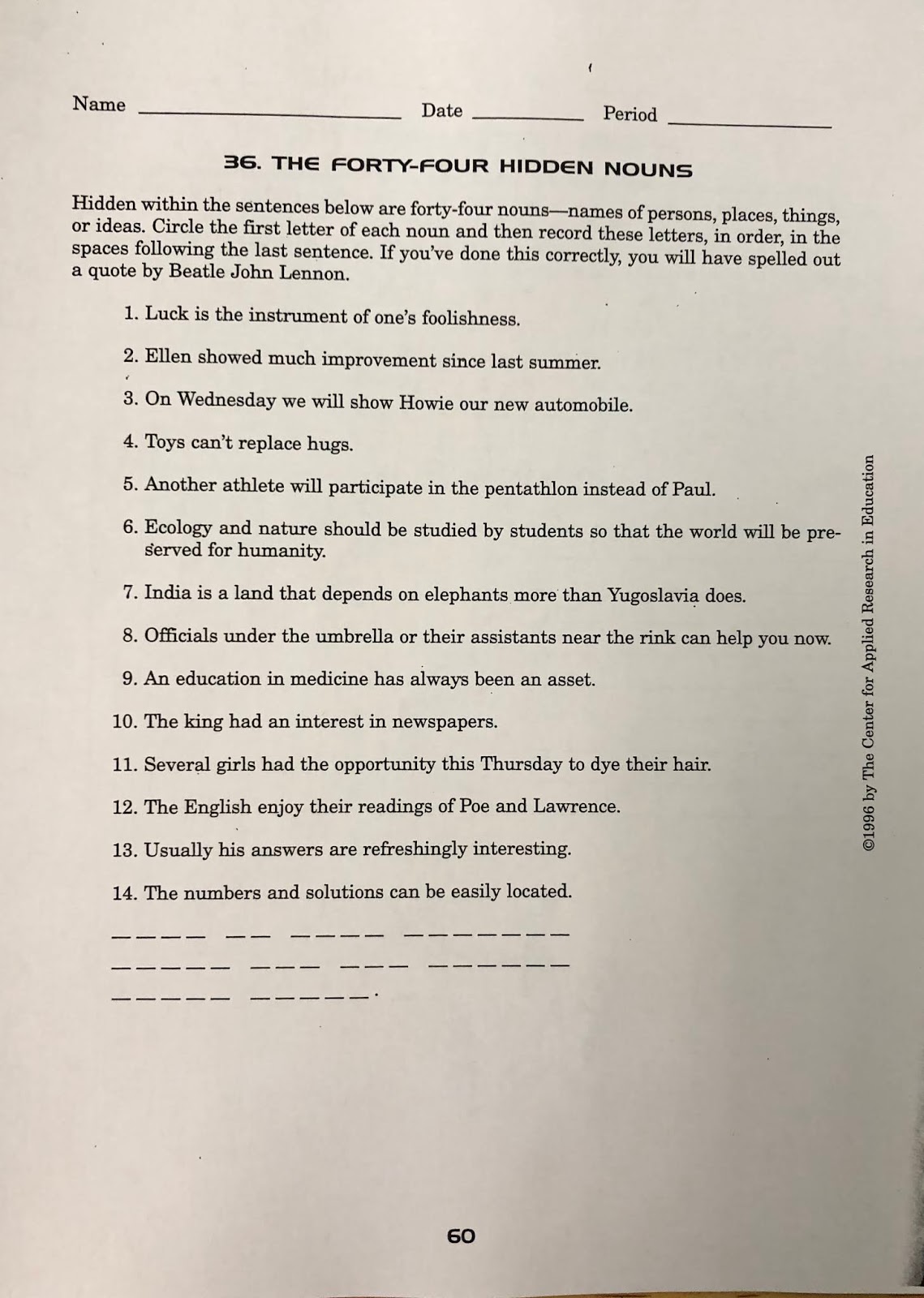

No registration is required to access these sources. Our printable worksheets and interactive quizzes are continuously being examined and refined in a classroom setting in order to maximize their comprehensibility and fluidity. Each worksheet has been formulated to make probably the most of page house, saving paper on the printer/copier. Practice drills are similar to what we do in regular video games like soccer.

It holds all knowledge necessary to characterize a spreadsheet worksheet. Add Multiple CursorsTo add multiple cursors in the identical worksheet, maintain down the or key and click on in every new location using the mouse left button or the touchpad. Click the context menu to pick a special active warehouse for the worksheet.

Simplify Addition Sentence Build your kid’s addition strategies abilities with this worksheet. The worksheet encourages college students to use their understanding of rounding of numbers to the closest 10, to search out the sum. Students will use compensation strategy to get to the result. Finding Double of Numbers From 1 to 5 Build your child’s doubles information expertise with this worksheet. The worksheet encourages college students to use their understanding of addition to seek out the double of a number.

Identify the Correct Group Boost your kid’s understanding of counting with this worksheet. The worksheet invites learners to work with a set of issues on counting utilizing objects and identify the right group. At this stage, college students will work with numbers inside 10.

Math is about diligence and persistence and worksheets can prove to be an efficient tool in engaging kids’ minds and helping them give attention to the underlying huge image. Printable math worksheets from SplashLearn can positively help to enhance their math skills. For practicing some math skills, there’s nothing more practical than a pencil and paper. Our free math worksheets for grades 1-6 cover math abilities from counting and basic numeracy through superior subjects corresponding to fractions and decimals.

Teacher creates worksheets to make sure holistic learning of the subjects. Comparing Groups of Objects Improve your child’s proficiency in counting with this worksheet. The worksheet consists of visual representations, which prepare college students for abstract ideas within the course. Your younger learner will have an thrilling time taking part in this worksheet. Represent Numbers on 10-frames Improve your kid’s proficiency in counting with this worksheet. Students will use their inventive thinking expertise to create a gaggle of objects utilizing the given info here.

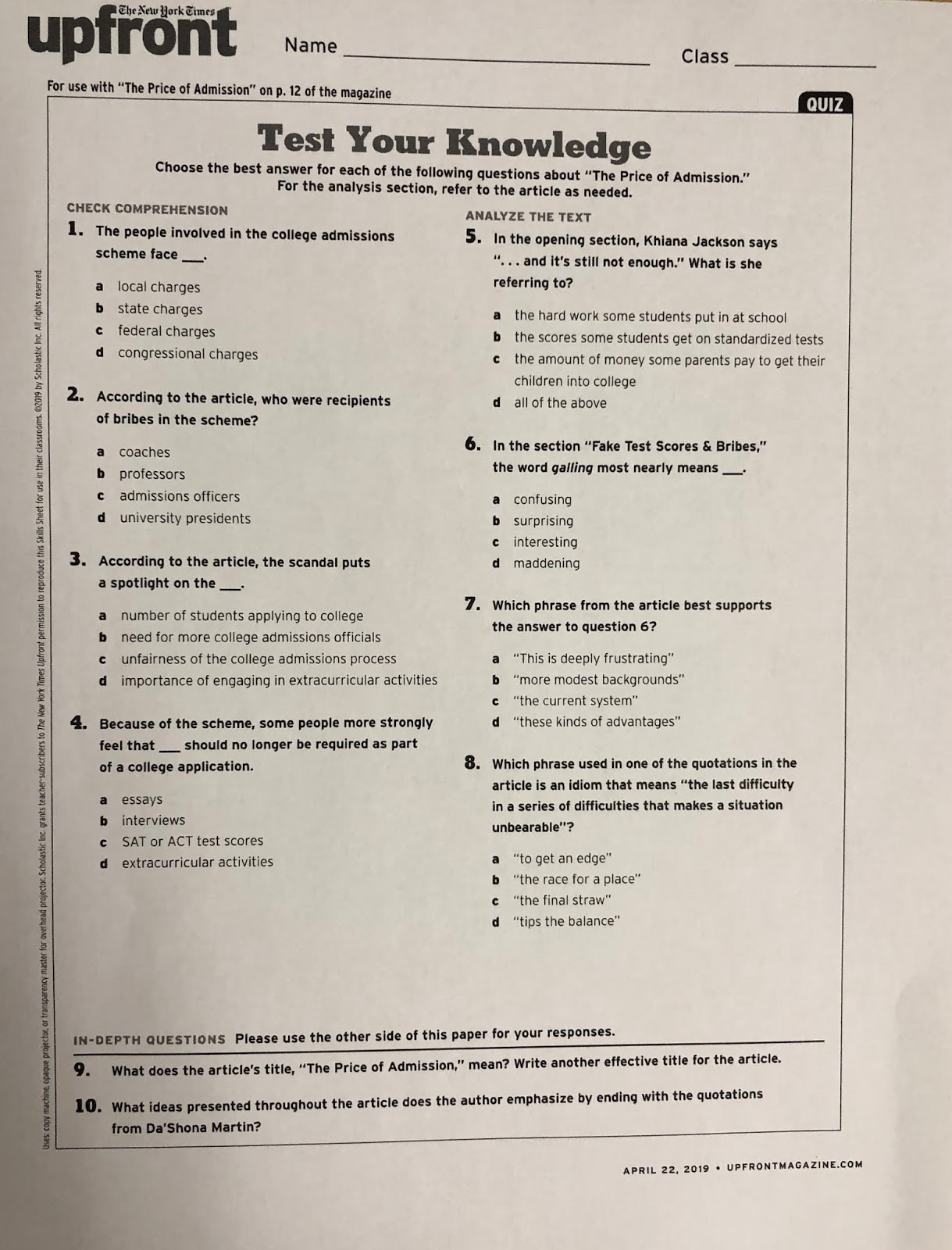

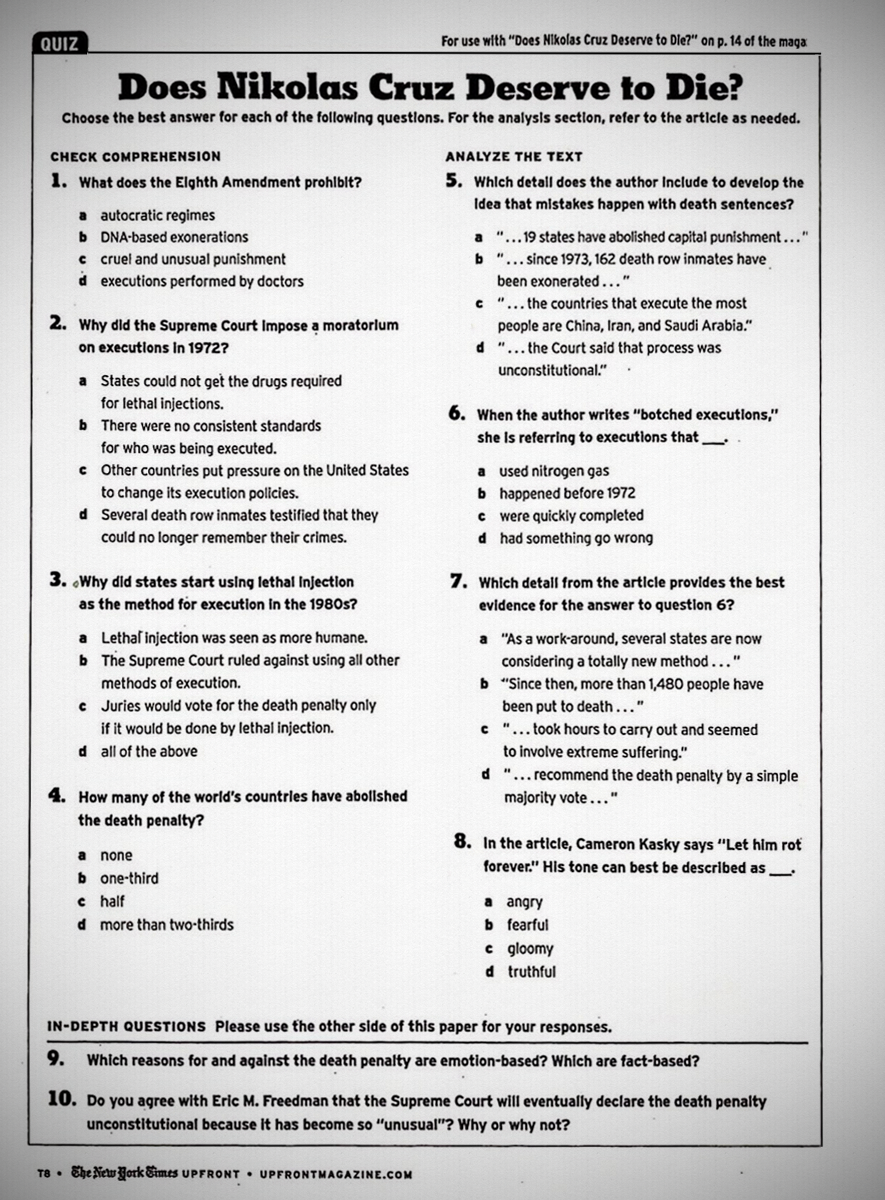

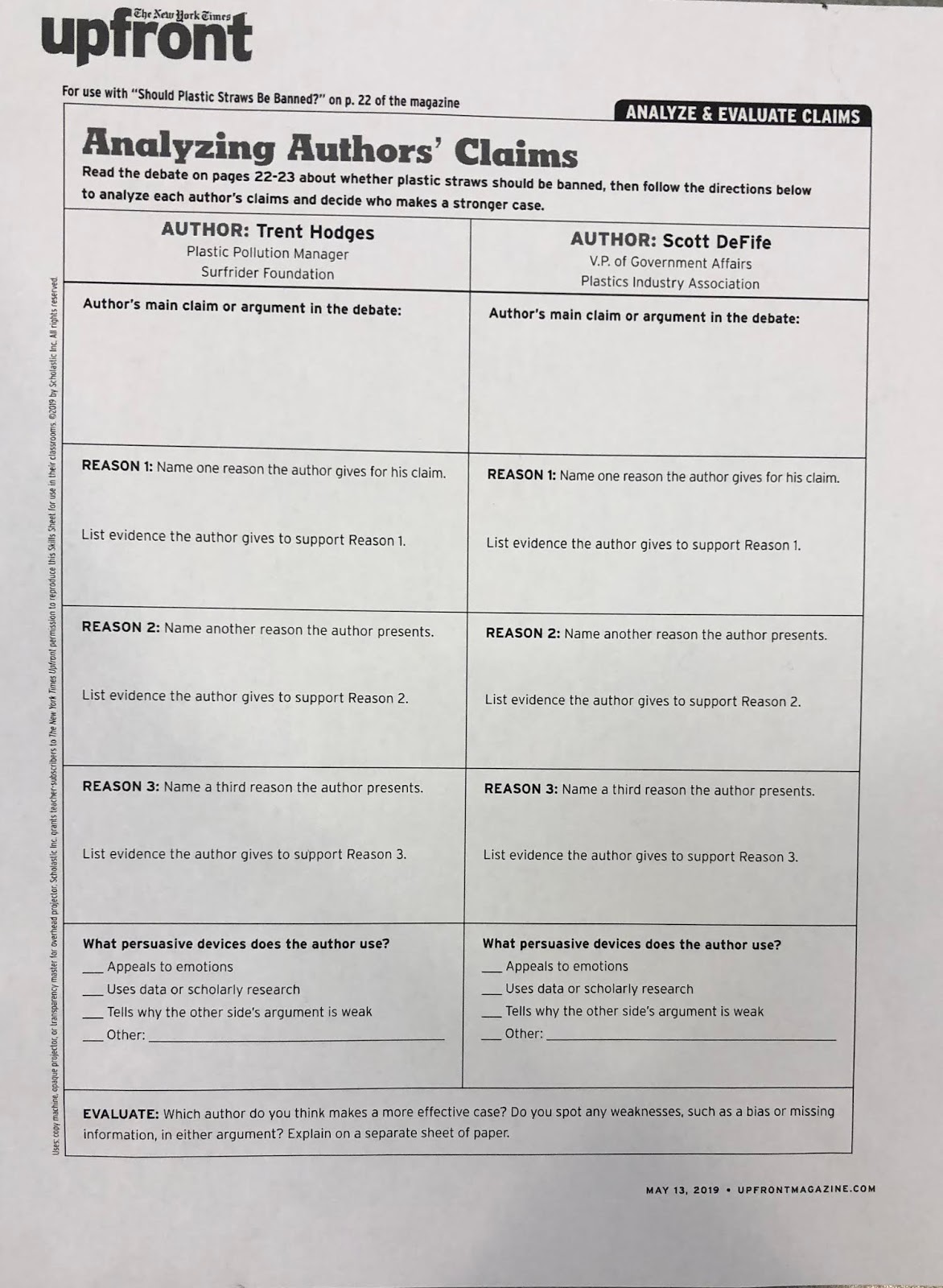

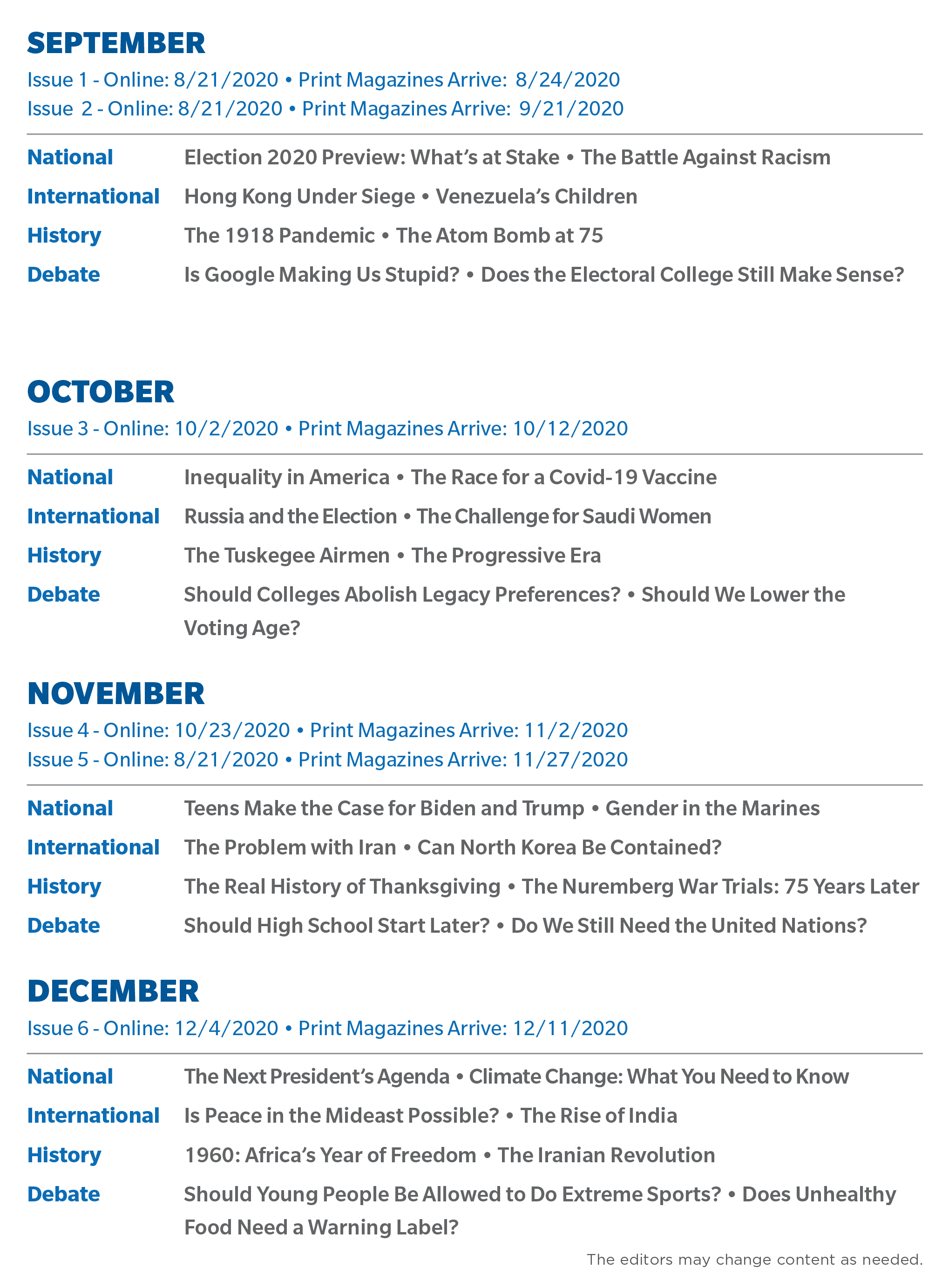

Fantastic Upfront Magazine Worksheet Answers

Diy Upfront Magazine Worksheet Answers. If you want to obtain all these incredible shots related to Upfront Magazine Worksheet Answers, press keep button to save the pictures for your laptop. They are prepared for transfer, If you’d rather and want to have it, simply click save badge in the post, and it’ll be instantly down loaded to your home computer. Finally If you want to find unique and recent image related to Upfront Magazine Worksheet Answers, divert follow us upon google pro or save this website, we try our best to give you daily update next fresh and new pics. We pull off hope you enjoy keeping here. For some up-dates and recent information roughly Upfront Magazine Worksheet Answers graphics, occupy kindly follow us upon tweets, path, Instagram and google plus, or you mark this page upon bookmark section, We try to manage to pay for you up grade regularly in the manner of all other and fresh photos, love your exploring, and find the perfect for you.

For full entry to hundreds of printable lessons click on the button or the link under. Printable phonics worksheets for elementary faculty college students. Teaching college students consonants, digraphs, two-letter blends and extra. Solve the issues on every web page and shade in accordance with the key to reveal a enjoyable, colorful thriller picture. If you wish to add a video from youtube, simply draw a big textbox and enter the video URL.

Identify More or Less Build your child’s comparison expertise with this worksheet. The worksheet involves working with a set of problems on counting using objects to compare groups, which helps younger learners solidify their understanding of the concept. We provide a big number of correct and concise ability building sources geared towards a range of capacity levels. We hope you find our sources visually appealing, straightforward, straightforward to locate, and capable of seize the essence of the English language.

Browse our database of 17,300 free printable worksheets and lesson plans for educating English. No matter when you teach youngsters or adults, novices or superior students – BusyTeacher will prevent hours in preparation time. Worksheet turbines are sometimes used to develop the sort of worksheets that comprise a collection of comparable problems.

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/WQB2MBZGB6QI2R6ZKHOTQRIA5Y.png)

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

[ssba-buttons]